The headline to the EC's Press Release read

State aid: Ireland gave illegal tax benefits to Apple worth up to €13 billion

Under a scheme that wobbled around in the public shadows since it was introduced in 1991, the agreement between Apple and the Irish Government served two principle purposes:

It reduced Apple's tax bill

and

It brought technology jobs to Ireland.

From a public policy perspective is achieved one major outcome:

- It helped to impoverish the Irish population relative to what might have been achieved.

The Irish people be damned.

Meanwhile, the Chinese people making the products, could also be damned. We know this from published research about Foxconn. As if to add insult to injury, Foxconn announced in May 2016 that it is resolving its human resources issue by replacing 60,000 employees with robots. And thus the Apple machine rolls on.

The EC tax news was welcomed by critics of the the contemporary global corporate system operating under neo-liberalism. The EU move sharply brought to the surface of public debate the way neo-liberalism had been structurally imbricated into everyday life through agreements between global corporations and national governments. The public has little knowledge of how they are made or why. Challenging these agreements has escalated, despite the appeal of the very devices - primarily iPhones - that make Apple a success. It is somewhat like an ugly fruit that tastes good: the eater rejects the object, yet enjoys the experience.

Clearly, the terrific personal and social benefits arising from the use of smart phones come at a cost. In this case, the cost of being a subservient nation relying on the decisions of a corporation to outsource parts of its financial interests.

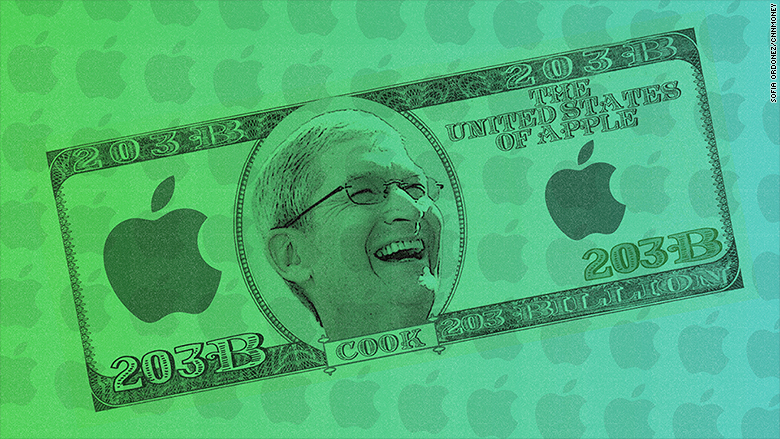

Source CNN Money

Previously, Apple and other technology firms have been able to control their message with Public Relations and publicity campaigns. That is why the EU announcement was like sour grapes to the Cupertino folk. Apple and Steve Jobs have been superb at using their events to sell hyper-personalized devices into the networked gee-wiz economy, flogging consumers the story that human value and virtue is tied to the private ownership of an Apple product. Millions of people accepted the narrative and bought Apple products, which for the most part, worked well.

Plus, they were none-too-subtly presented as luxury and social status items, with an expensive price point. (I use an Android because I could not abide the proprietary aspect of Apple iTunes and music libraries, which originally forced me to use Apple products on ipods). New entrants into the global economy, especially consumers in China, are new user-markets, and often, along with manipulable consumers everywhere, status seekers, for whom and iPhone signifies ascension into the middle class... of something. (More research on this please).

Apple CEO Tim Cook summarized the Chinese market:

I've never seen as many people coming into the middle class as they are in China," ... "That's where the bulk of our sales are going. We're really proud of the results there and we are continuing to invest in the country.In 2015 iPhone sales in China surpassed sales numbers in the US. But the real story is the estimated $200 billion held offshore (the USA) by Apple.

It is worth noting that the US financial press tend to agree with Apple's strategy of keeping its profits in cash offshore, rather than repatriating it to the US to be taxed and invested. (How about investing in depressed parts of the South, the rust belt areas of the north east, and in education and training?)

Meanwhile, the Irish Government's technology sector has put up some impressive numbers for technology investments. For examples in 2014, Ireland's Direct Investment Agency noted the following inward movements of announced investments:

- Intel’s recent $5 billion spend at its Irish fab.

- Microsoft’s €170 million data centre expansion, bringing its total investment to €594 million.

- Ericsson: 120 additional R&D positions.

- SAP: 260 new roles (R&D/technology support).

- PayPal: 400 new positions (including customer solutions/telesales).

Governments and corporations seek to control the narrative around the shift to high quality technology sector jobs. (I was once employed doing pretty much that in helping to establish Multimedia Victoria (Australia) in 1994-1996.)

In this context, Apple controlled the narrative, the inflated price for their products and a massive pipeline of profit. Then came the EC and several other public policy institutions, including the G20, suggesting another perspective on the Apple success story. Indeed, at its Brisbane, Australia 2014 meeting, the G20 issued the following (on 15 November):

13. We are taking actions to ensure the fairness of the international tax system and to secure countries’ revenue bases. Profits should be taxed where economic activities deriving the profits are performed and where value is created. We welcome the significant progress on the G20/OECD Base Erosion and Profit Shifting (BEPS) Action Plan to modernise international tax rules.

The EC launched an inquiry into "transfer pricing" in 2014. It is too obvious to point out that once the interests of major global institutions like the G20, the OECD and EC converge, significant progress towards democratic polity can result? The history of political economy would suggest that coordinated public policy interest serves as a major prompt for reform. Although it is usually too little too late.

Finally, 31 August 2016, the New York Times headline, one among many, pointed to the wind change: The-tax-man-comes-for-apple-in-Ireland.

The first response by Apple was predictable: A massive defense of its agreement with the Irish Government, promoting the thought that this is the pointy end of corporate America, and why senior executives earn their inordinate salaries:

Apple CEO Tim Cook collects his paycheck! The Irish Government joined in, although as RT reported, rejecting a payout of about 14 Billion from Apple! There is nothing quite as undignified as hearing politicians explain why the public should be worse off.

The response from the US government varied somewhat depending on the media outlet reporting it. The Wall Street Journal opted for "the EC is bad" subtext, in a commonplace US trope of making an enemy of anything that disagrees with it. (As a former rugby player, I think Americans would gain much from not only the rugby habit of shaking hands with opponents after a game then going to have a beer.) Active Telecoms at least covered the story from a distance. Although like The Guardian, it noted the abrasive tone coming from Treasury Secretary Jack Lew, who came up with the "supranational tax authority" criticism of the EC.

Apparently it is all right for US companies like Apple to be supranational, but not for the governing body for the EU to insist on its rule of law, when one of its member nations (Ireland) engages in State Aid (to Apple).

The ethics of all this is engaging, deserving much more public discussion.

More importantly, finding a way to critically engage with the behavior of Apple and the Irish Government offers a way to think through what the Australian academic Phillip Anthony O’Hara referred to as "The Corruption Industry."

Writing in the Journal of Economic Issues June 2014, O'Hara's article "Political Economy of Systemic and Micro-Corruption Throughout the World," made the point that corruption's long history incorporates the following:

...the promotion of vested interests against the common good in the form of bribery, fraud, embezzlement, state capture, nepotism, extortion and others.In many respects, the neo-liberal financial structure that made it possible for Apple and Ireland to make arrangements are an extension of this set of corrupt practices. In effect, Apple-Ireland serves as a case study for this method of interaction, in a political economy model that normalizes a kind of corporatized agency operating outside of and against the public interest.

The answer to the question in the title, does Apple Ireland epitomize "The Corruption Industry" is clearly Yes.

The EC should be congratulated for taking action in attempting to put a stop to a corrupt system of tax avoidance and financial organization. It should be encouraged to pursue the public interest and civil society, against the private and privatizing interests of corrupt and corrupting individuals, governments and corporations.

No comments:

Post a Comment